Atos shareholders have endured a 84% loss from investing in the stock five years ago

Atos SE (EPA:ATO) shareholders should be happy to see the share price up 13% in the last month. But that doesn’t change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 88% lower after that period. While the recent increase might be a green shoot, we’re certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don’t have to lose the lesson.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they’ve been consistent with returns.

See our latest analysis for Atos

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

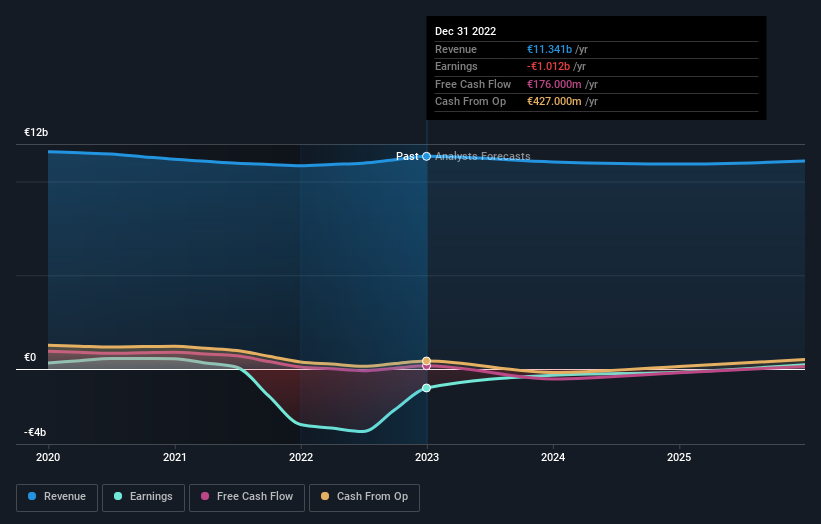

Atos has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

The revenue decline of 0.7% isn’t too bad. But it’s quite possible the market had expected better; a closer look at the revenue trends might explain the pessimism.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Atos is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Atos will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

Investors should note that there’s a difference between Atos’ total shareholder return (TSR) and its share price change, which we’ve covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Atos shareholders, and that cash payout explains why its total shareholder loss of 84%, over the last 5 years, isn’t as bad as the share price return.

A Different Perspective

While the broader market gained around 21% in the last year, Atos shareholders lost 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We’d need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It’s always interesting to track share price performance over the longer term. But to understand Atos better, we need to consider many other factors. Case in point: We’ve spotted 2 warning signs for Atos you should be aware of, and 1 of them is potentially serious.

https://simplywall.st/stocks/fr/software/epa-ato/atos-shares/news/atos-epaato-shareholders-have-endured-a-84-loss-from-investi

Restez automatiquement averti à chaque nouvel article du blog, au rythme maximal de 3 fois par semaine. Inscrivez vous à notre NEWSLETTER, y compris pour les membres du forum qui part défaut ne reçoivent pas la Newletter.

L’espace inscription est sur page d’accueil en haut de la colonne de droite, juste sous le price-ticker de l’action (sur la version PC du blog). Vous pourrez vous désincrire à tout moment.