Atos – Turnaround Might Be Coming In 2023-2024

sankai

Dear readers/subscribers,

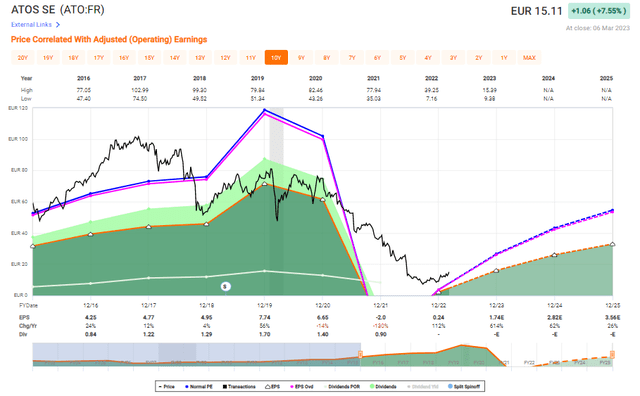

Sometimes a picture can say more than a thousand words. In the case of Atos (OTCPK:AEXAF), this picture paints a very realistic state of the company and its decline over the past 3 years.

Atos EPS/Valuation (F.A.S.T Graphs)

In my past article on Atos, I describe how things could get « this bad », and why I haven’t sold my shares in the company which, as you might expect, are looking at a very negative sort of trend, fully in the red at over double digits.

Of course, eventually, the company will turn around. I do not believe Atos is in any way in a position to go bankrupt or truly fail.

Why is that?

Let me show you.

Updating Atos for 2023 – at some point, the thesis will become positive

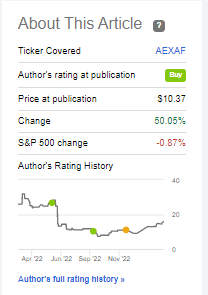

I mean, my thesis on the company has been positive to a degree. Compared to my latest « BUY » article, the company is up 50%, which is a recovery. However, I haven’t bought more shares myself, and I would’ve been surprised if any investor has really gone deep into Atos, based on the risk/reward ratio in the investment. Nonetheless, the RoR has been positive.

Atos Article RoR (Seeking Alpha)

Finding the bottom and finding the upside, or even positive enough fundamentals to justify an investment here has been hard. Not because the company is bad – it’s not, not as such. Atos is a multinational French IT consulting company, which was originally formed from a merger of a French and a Netherlands giant a few years back. On paper, it sounds like the perfect play on quality IT – that’s what drew me to the company initially – that and being a heavy investor in Siemens (OTCPK:SIEGY), which many of this company’s operations were initially a part of.

The company includes at this stage, former divisions of Siemens, Bull S.A, Xerox IT, Syntel, and others. The company has been growing primarily through acquisitions, and initially prior to its current iteration, consumed a number of appealing peers.

Remember also, Atos was BBB+ not that long ago. The decline in this business’s credit rating has been one of the most spectacular falls-from-grace I’ve been witness to over the past decade. Atos is now at BB, junk-rated with no real prospect of going higher in the near term.

Despite a 50% recovery, my position is still firmly in the red. Most of this is justified, of course. The company gave a massive profit warning in 1H21 and downgraded the entire forecast around the time I published my first piece. This was then followed by a long-awaited CEO’s resignation, replaced with Rodolphe Belmer.

Since then, Atos has been in recovery mode – and 2022 results are the latest indication in how that recovery is working out at this time.

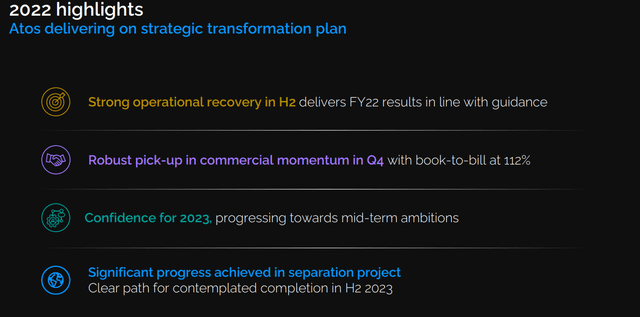

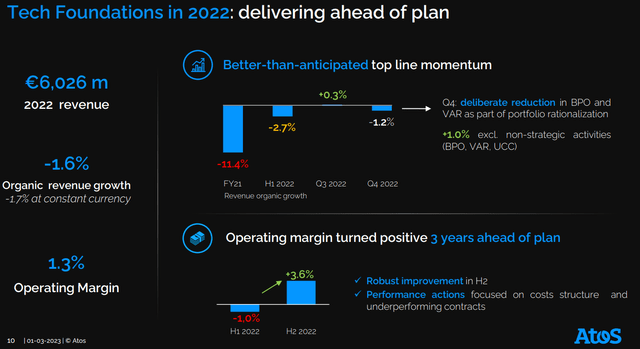

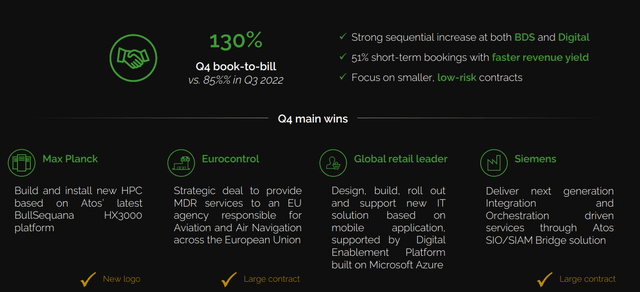

Overall, I would say 2022 came in better than expected. Atos delivered a good recovery in line with the guidance I thought to be a somewhat positive, decent pick-up in order flow, with a triple-digit 110%+ book-to-bill, and seems set to move towards its later-stage ambitions. This also includes the separation project I touched on in my last Atos Piece.

Atos IR (Atos IR)

Financials were decent enough. Despite all the headwinds, the company managed to generate over €11.3B in annual revenues, which is growth organically both at constant and actual FX. This also represents a positive OM of 3.1% – nowhere near where it should be, but positive. Atos didn’t manage positive FCF, and its net debt is still above 2x, at 2.4x today, but it did manage a positive EBITDA of over €1B, while maintaining a 110,000+ headcount for the global organization.

There has been an incredible turnaround in the company’s personnel division in the last year. Over 20% of the company’s personnel has been more or less replaced in a relatively short time, with most leaving or being restructured/dismissed, only to be almost immediately replaced by a net positive hiring number resulting in that 110k+.

2022 was the year, the company argues, where we see the first actual signals of the turnaround plan working according to expectations. This includes strong pricing actions, disposal of non-core assets and operations, and getting its global teams focused on getting back on track. Restructuring is currently focused on US and UK operations.

This is eventually expected to result in stronger revenues, with new large deals based on the company’s position as a global leader in managed infrastructure services.

Atos is already the European leader in private/hybrid and sovereign cloud services. The company’s annuals might not look much to the world here, but compared to 2021, they’re actually very good.

Atos IR (Atos IR)

The big surprise that I also consider to be key here is the fact that Atos managed to generate positive OM – because this was well ahead of the company’s plan. We’ll have to follow the business to make sure that this isn’t a one-time fluke, but for now, things seem promising.

Why is it promising?

Well, because commercial performance has really accelerated with massive growth that enables Atos to be more selective in deciding deals and orders. But the early large deals that the company managed here have been amazing, including a deal with UEFA for 8 years, the world’s largest healthcare company to deliver a digital workplace engagement extension, and a newly formed global consumer company to deliver a digital workplace service over no less than 3 years.

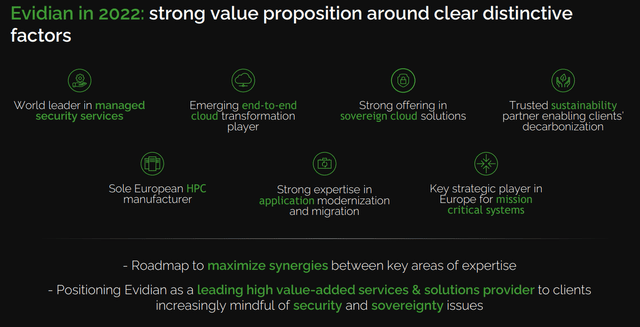

The company’s Evidian segment is also performing very well.

Atos IR (Atos IR)

Companies manage easily to make things sound positive in an IR presentation, but the fact is that even digging down into the more granular trends and in the math, we do see advantages here. Evidian is seeing significant revenue expansion as well as a good operating margin. The OM for the segment is at 6.7%, and this is up nearly 100% compared to 1H22 due to cost actions, utilization of resources, and higher volumes as well as well fixed cost absorption. The segment alone generated over €5.3B in annual revenues, and 4Q22 alone saw a massive bump in momentum on the commercial side.

Atos IR (Atos IR)

A few things here.

It’s very clear that the company isn’t recovering to positive trends for the foreseeable future. What I mean is that dividends and pre-crash results, we’re a far away from that. However, what’s also clear is that the scandal hasn’t exactly in any way take the shine off this company in terms of its customer appeal. Some of the new contracts the company has managed is to companies such as Eurocontol, Max Planck, and Siemens itself.

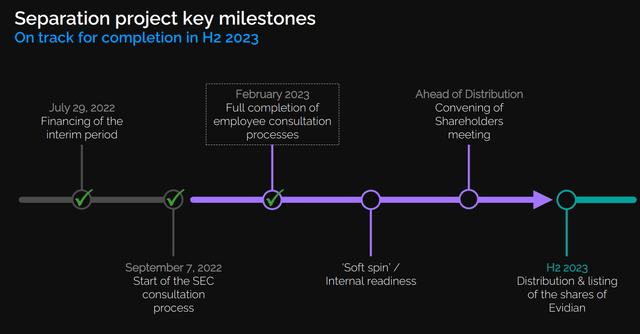

Atos has managed to secure over 80% of its €700M divestment program already and is seeking to monetize some of its stake in Evidian, which would enable the company to pay down debt, invest or do what it needed to do, potentially raising the credit rating back to low IG-rating as opposed to junk where it is today. The company is in talks with Airbus (OTCPK:EADSY) to sell off nearly 30% of the company in accordance with its separation plan of Evidian. This plan looks as follows.

Atos IR (Atos IR)

Atos isn’t « back » as of yet. The company has generated revenue growth and positive operating margins as well as positive EBITDA, and substantial improvements in net income.

As of yet though, some of the important metrics still aren’t positive or close to positive. Outlook for 2023 remains positive, and once the company’s pricing and divestment actions are finished, we can look forward to a substantially improved Atos, with a potentially changed credit rating for the better.

Despite a 50% RoR since my last positive « BUY » article, I see potential for buying the company here. it’s currently trading at €15/share, and this is my valuation approach for Atos at this particular time.

Atos Valuation – higher, but not even close to full value

First off, the company’s average valuation targets in terms of the analysts following the company have not caught up. 12 analysts are giving this company a range from €8 to €21/share, with an average of about €12.35, which means that this company currently is considered a « HOLD ». Only one analyst has a « BUY » rating on the company here, and the share price implies an overvaluation of almost 19% at this time.

However, this is also a good time to remind you that Atos traded with a €46+ PT less than a year ago, with most analysts either at a positive or a « HOLD » rating.

There is no question that this is a dicey forecast and expectation. That is also why I’m still not pouring money into Atos at this particular time. It’s a high-risk investment in the sense that we don’t know when a reversal will come – though I think it’s well-established that it will come.

My valuation models for Atos continue to show a massive potential upside in every perspective except P/E and dividend yield. This continues to make a lot of sense because P/E is dependent on earnings, of which the company had very little in 2021A as well as in 2022A, and yield is dependent on, you know, dividends, which the company has cut.

The potential upside for Atos here remains massive – well over 200% in the case of normalization, even when impairing the company by as much as 20-30%.

More importantly, any sort of non-trough, non-impaired EPS numbers and actual earnings call for a triple-digit upside in my DCF model – though DCF at this stage makes only a limited amount of sense given the company’s volatility.

However, listen to this case. If the company recovers somewhat to a 13-14x P/E, which is the company’s 4-5-year average even including the past few years of trough, this could result in a more than 220% total RoR with over 50% annually, even without the company’s dividend. So the upside is most certainly there if you’re willing to take the risk. That’s also why I am now keeping my position in the company. I don’t see fundamental deterioration as a likely outcome – not at this stage, with most of the deals and moves lined up to really move the company into a better overall position.

However, is the company good enough at this stage to actually invest in with fresh capital, if you’re willing to take the risk?

I would say yes, it can be.

If we give the company’s various assets a valuation, we can see a real disconnect from today’s share price – Infrastructure, Big Data, Business, and the others to a valuation of at least €8B, even impaired by yet another double-digit. This brings us, net of debt and payables, to around €4-6B NAV range, which means that the company’s per-share NAV is no lower than at least €25/share, which is where I put my latest share price target.

Atos’ current valuation still means that you can pretty much discount it however you want – you won’t reach a €9-€16/share price unless you completely go off the rails here and start treating this company as a « failed » business.

This might have been a risk a year ago – but this is no longer what we have here.

Atos remains one of my very few « Spec BUY »-rated companies, and I give the company a continued « BUY » here.

Thesis

My thesis for Atos is as follows:

- Atos is a fundamentally questionable company at this time – but the substance is solid, once the company gets its flow from top to bottom line under control once again.

- The question is how long this will take. When FCF turns positive and when operating margins tick up above 3% for more than a quarter at a time, I would be seriously interested in this company again. I maintain my share position here, but FCF isn’t positive yet, and OM is only above 3% in parts of the last fiscal.

- For now, it’s a rare « Speculative BUY » with a PT of around €25/share for the native share.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

It’s not yet considered fundamentally safe, but I do consider it qualitative given its progress, and I do consider it cheap and with an upside. The lack of a dividend may kill it for most of you though. It’s a 3/5 for my criteria, but I go for a « Spec BUY » here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.