Daniel Kretinsky has a huge cash pile available for acquisitions that’s fueling a series of high-profile deals over the past year, especially in France.

Armed with a war chest that has made him one of the most prominent dealmakers in Europe, he is now taking advantage of the record profit his energy business is churning out to snap up companies pressured by high debt. Besides winning a deal to gain control of troubled French supermarket chain Casino Guichard Perrachon SA in a multi-billion-euro restructuring process last month, he has announced investments in sectors as diverse as technology and book publishing.

The 48-year-old owner of the largest privately-held energy conglomerate in Europe has a net worth of about $8 billion, according to the Bloomberg Billionaire Index, buoyed mainly by a bumper year for power utilities during the continent’s energy crisis. His main company, the Prague-based Energeticky a Prumyslovy Holding AS, had €37 billion ($40.1 billion) of revenue last year, a fourfold leap since 2020, and expects its business to keep growing.

That’s boosting the cash-pile Kretinsky has available for acquisitions, fueling a series of high-profile deals over the past 12 months — especially in France — that have put him under the microscope of the country’s business and political elite. For years, he projected an image of an elusive businessman, and while he remains protective of his private life, he has begun to discuss his investments more openly — speaking to French media during the Casino deal, for instance, to explain his interest in the business.

Kretinsky declined to comment.

The self-proclaimed Francophile, who owns a townhouse across the street from the Elysee Palace — the residence of the French president — last month secured his biggest prize in the country to date. He led a group of investors who reached an agreement to recapitalize and gain control over Casino, which had been hamstrung for years by stagnant sales in the highly competitive French grocery market. The restructuring deal, led by one of Kretinsky’s investment vehicles, EP Global Commerce AS, is set to give the billionaire a stake of about 40% in the retailer.

Less than a week later, another company owned by Kretinsky, EP Equity Investment, said it was to buy Atos SE’s ailing legacy IT outsourcing business, Tech Foundations, which has struggled to adapt to the cloud era. In June, Kretinsky sealed a deal to buy Editis, the second-largest book seller in France, and in March he raised his holdings in retailer Fnac Darty to 25%.

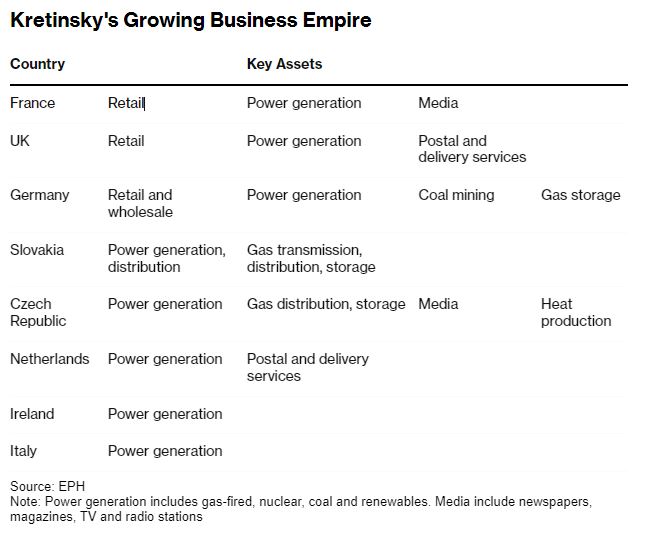

From the outside, it is difficult to discern a strategy behind the purchases, but Kretinsky has previously said that as part of his diversification efforts away from energy he would target industries that provide essential products and services, things like infrastructure, retail and postal services.

.

The strategy is unfolding as many businesses across Europe still reel from the impact a series of economic shocks — the pandemic lockdowns, supply-chain disruptions and central banks’ efforts to tame high inflation by raising interest rates. That has weighed on asset prices, creating opportunities for acquisitions comparable to the market environment in the aftermath of the global financial crisis more than a decade ago.

The group has also shown itself to be opportunistic, with the most visible example being its investment into a stake in US department store chain Macy’s Inc. in mid-2020. While initially billing the purchase as a strategic move, a surge in the stock price prompted Kretinsky to sell most of his Macy’s shares with a profit of about $50 million just a few weeks later, according to a person familiar with the deal who asked not to be named because they were not authorized to speak publicly about the trade.

Kretinsky has previously spoken about developing affection for France in his childhood, and his official biography says he spent a semester at the Université de Bourgogne in Dijon during his law studies in late 1990s. He is now that rare thing, a foreign shareholder in some of the country’s most influential media. Among other assets, he is a minority shareholder in the centrist newspaper Le Monde and TV channel TF1, and also owns various magazines including Elle, giving him an entree into the French establishment.

Kretinsky’s business empire includes several key units, with the biggest one, EPH, holding assets valued at just under €31 billion at the end of last year. While he is making his acquisitions through several companies, he usually works with a relatively small team on most of his deals, whether it’s buying a power plant or acquiring a retail giant, according to people who have cooperated with the company and are familiar with its inner workings. The core deals group is no more than 50 people who perform most of the number-crunching and business analyses that other conglomerates traditionally outsource to investment banks and advisory firms, said the people, who spoke on the condition of anonymity to discuss business relations.

The tight circle of the billionaire’s closest colleagues include Chief Financial Officer Pavel Horsky, who has been with the company since its inception in 2009 and holds a master’s degree in mathematics and previously was a senior corporate risk advisor at Royal Bank of Scotland. A group of Kretinsky’s top managers also holds a minority stake in his companies.

.

While the French media and some members of the country’s elite initially feared the Czech businessman had ties to Russia and viewed him with suspicion, he has become a respectable member of the establishment within just a few years, according to Jerome Lefilliatre, who has met Kretinsky three times and published a book about him in 2020. One of Kretinsky’s companies operates a gas pipeline in Slovakia that transits natural gas to customers in the European Union, but he rejects any links to the Russian economy. The fact that Kretinsky managed to secure the deal for Casino, one of France’s best-known brands, illustrates how little resistance he has faced, Lefilliatre said. The country has previously objected to a non-French investor taking over a grocery chain when it balked at Canada’s Alimentation Couche-Tard Inc. attempt to buy Casino rival Carrefour SA more than two years ago.

“People quickly realized he’s very European,” Lefilliatre said, referring to Kretinsky’s declared support for democratic values. He recalled how the billionaire met many of France’s leading business and political figures at his favorite hotel in Paris, the 5-star Le Meurice. “He has succeeded in everything he tried, including in building up his reputation in France.”

Read More: Billionaire Kretinsky on a Buying Spree of Unloved French Assets

A lawyer by training, Kretinsky got his start in business in 1999 at private investment firm J&T, named after its founders Ivan Jakabovic and Patrik Tkac, in Prague. Speaking to a group of students more 15 year later, Kretinsky said he earned about $1,000 a month. He also recalled that his first large financial bonus came about seven months into the job, when he was awarded a million koruna — about $45,000 at the current exchange rate — for winning a lawsuit for the firm.

Within a decade, he formed the energy group EPH — where he initially held a minority stake — with the backing of partners from J&T and the late Czech billionaire Petr Kellner. Through acquisitions, he created a conglomerate of more than 70 companies operating in nine countries and industries including electricity production and distribution, natural gas transmission, storage and supply as well as trading and logistics.

After Kellner died in a helicopter crash in 2021, Kretinsky became a member of a small group advising his heirs who own the richest family office in eastern Europe. Kellner sold his shares back to EPH in 2014, and subsequent changes in the company’s ownership structure led to Kretinsky to obtaining a controlling stake and his investment partner Tkac getting a minority stake.

The foundation of Kretinsky’s wealth came with a betmore than a decade ago that it would take Europe longer to wean itself off fossil fuels than its green strategy envisaged. EPH scooped up assets that publicly traded utilities were forced to offload as banks, increasingly under pressure to address environmental, social and governance concerns, curbed financing over ESG standards. That strategy has drawn ire from environmental organizations, which complained about weak scrutiny over privately-held utilities owning sources of carbon emissions.

.

Kretinsky’s company said it wants to invest €10 billion in renewable energies, in a plan that includes building new gas-fired power stations, which would be eventually converted to hydrogen-based electricity production. The company’s view is that the transition to green energy should take place while securing affordable electricity for all consumers. “We intend to transit hydrogen, distribute hydrogen, store hydrogen and we intend to use and burn hydrogen to create power in the relatively near future,” Gary Mazzotti, the CEO of EPH’s unit EP Infrastructure, said on an earnings call in May.

The plan to invest in gas-fired stations, which will then be “hydrogen-ready,” is still an extension of the fossil-fuel business model and currently there is neither green hydrogen, a corresponding infrastructure, nor sufficient amounts of renewable energy to produce the hydrogen, according to Claudia Kemfert, professor of energy economics at the DIW research institute in Berlin. “Rather, a future model is described here, which can only become realistic if the corporation completely changes its business practices,” she said.

Read More: Elusive Billionaire Bets Against Europe’s Green Plans—And Mints a Fortune

As he diversified outside energy, Kretinsky and Tkac together acquired stakes in a number of industries across Europe. Their holdings include shares in German retailer and wholesaler Metro AG, British supermarket J Sainsbury Plc, International Distributions Services Plc, the owner of Royal Mail, and Foot Locker Inc. An avid football fan, the billionaire also owns the Czech champions Sparta Praha and is a minority investor in the English Premier League club West Ham United FC.

His company headquarters is an Art-Nouveau townhouse in an exclusive part of central Prague. The tree-lined boulevard, called Paris Street, is surrounded by boutiques of luxury brands including Louis Vuitton, Dior and Hermes.

Kretinsky was born in the second-largest Czech city of Brno, where he studied law at the Masaryk University. According to local media, his father is a professor of computer science at Masaryk University and his mother is a lawyer who served as a Constitutional Court judge. While he has stayed away from Czech politics, his company was embroiled in a rare public spat with the government over the windfall tax on the energy industry. Last year, EPH said it would relocate its commodity trading business abroad, arguing that the unit generates most of its profit outside the Czech Republic and subjecting it to the local windfall tax was “completely nonsensical.” The company later said it transferred part of those operations to Switzerland and the UK, but that it kept a large portion of the business in the Czech Republic.

Some of his recent deals have also attracted scrutiny in France. In July, dozens of lawmakers from the conservative and usually pro-business Republicains party published a joint letter to express concern that ownership of Atos, which does work for the military and is developing supercomputing capabilities, could fall out of French control. “The possibility of having such a powerful foreign player getting closer to our ultra-sensitive military capabilities raises all of our attention,” the lawmakers wrote in the opinion piece, pointing at a “major risk” of foreign interference on crucial sovereign defense systems.

A spokesperson for Kretinsky responded that he won’t increase his stake in Atos SE’s big data and cybersecurity business, Eviden, beyond 7.5%, and won’t have an “active role” in the company.

There were also politicians who emphasized the positive impact of his money on the French economy.

“You can’t be too picky if you want to attract foreign investment to France,” Christophe Marion, a lawmaker and member of French President Emmanuel Macron’s Renaissance party, said. “Kretinsky is not American and not Chinese after all. We’re talking about European capital.”

=====

SI VOUS ESTIMEZ L’ATTITUDE DE LA GOUVERNANCE D’ATOS N’EST PLUS TOLÉRABLE, À SAVOIR UNE DESTRUCTION À PETIT FEU DES CAPITAUX PROPRES D’ATOS, ET LA POSSIBLE FAILLITE DU GROUPE,

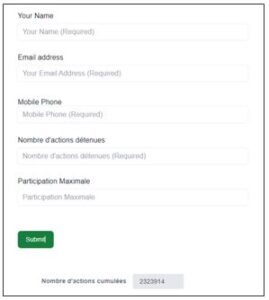

alors ADHÉREZ à l’association UDAAC, [l’union des actionnaires d’Atos en colère] et inscrivez-vous sur l’agrégateur d’actions pour comptabiliser notre % du capital « de concert » (cliquez ci-dessous).

L’UDAAC est une association « loi 1901 » immatriculée en préfecture, à vocation unique de défendre les actionnaires d’Atos contre la gouvernance qui détruit à petit feu l’entreprise, afin de mandater un cabinet d’avocat spécialisé en défense d’actionnaires pour réaliser des actions auprès de l’AMF, pour inscrire des résolutions à l’AGE de novembre dans le but de destituer Bertrand Meunier et la moitié du board inféodé, bien-entendu, annuler l’augmentation de capital, et surtout d’annuler le chèque de 1 Md€ versé par Atos à Kretinsky pour garder TFCo dans le giron d’Atos.

Si vous êtes suffisamment nombreux à nous rejoindre, et alors que le budget de l’association soit suffisant, nous assignerons individuellement devant les tribunaux Bertrand Meunier et tous les administrateurs individuellement.

Pour cela, il nous faut réunir des fonds pour financer ce combat, car l’argent est le nerf de la guerre. Il y aura des frais d’avocats très importants ! Mais également des frais d’agence de communication pour nous faire entendre. L’UDAAC a un besoin en fonds énorme pour nous assurer la victoire face aux avocats de Meunier qui bien sûr va choisir les plus chers vu qu’il paie avec votre argent !

L’UDAAC propose une participation de 6 cts par actions détenues, montants qui seront gérés méticuleusement par le bureau de L’UDAAC dont le président et le trésorier sont experts-comptables et inscrit au conseil de l’ordre des experts-comptables et travaillent bénévolement pour l’association.

Union Des Actionnaires d’Atos en Colère

Association 1901 immatriculée en préfecture

[email protected] www.udaac.org

Je rappelle que pour tout échange d’idées, suggestions, un forum spécifique a été créé : forum.bourse.blog/udaac/

===

Restez automatiquement averti à chaque nouvel article du blog, au rythme maximal de 3 fois par semaine. Inscrivez-vous à notre NEWSLETTER. L’espace inscription est sur page d’accueil en haut de la colonne de droite, juste sous le price-ticker de l’action (sur la version PC du blog). Vous pourrez vous désinscrire à tout moment.

oui et ? tu sais vraiment plus quoi mettre sur ton blog pourri

Blog pourri que tu lis tous les jours. Ce monsieur appelé Lionel Devanton met un à deux commentaires par article depuis 2 mois pour dire que ce que j’écris est de la merde, mais il est rivé à lire tous les articles. Si je passais en version payante, ce serait mon pilier de comptoir 😀

Étonnant, non ? Cet article ne remet nulle part en doute l’intégrité et l’origine de la fortune de M. Křetínský. Comme quoi, seuls Les Républicains fantasment sur le sujet (et restent étonnamment muets à propos de l’argent libyen ou russe touché par leur dernier président.