Voilà en substence, ce qu’un peu agacé a répondu Elon Musk ce mardi à une Xème lettre soporifique où Thierry Breton le narcissique se prenant pour le roi du monde, qu’avait eu l’indélicatesse de lui envoyer quelques heures avant son interview de Trump (Disclaimer, je supporte le camp adverse).

Ce Thierry Breton, il commence à nous les briser menu, et Elon Musk qui avait une première fois bombé le torse à Paris pour marquer son territoire, y est allé de manière plus franche, vis-à-vis du prère Breton, aigru de ne pas avoir pu prendre la présidence de l’EU (ouf d’ailleurs).

Il n’a toujours pas compris le papy gâteux qu’ils s’en tapent complet à la Silicon Valley de ses élucubrations narcissiques.

Le blog un peu agacé que Mr Zéro dette nette, mais qui a quand même coulé la boite se la ramène en kakou de service alors qu’il devrait plutôt se faire oublier en ce moment. Même Meunier et Bihmane ont clairement dit qu’ils avaient récupéré une boite en lambeau après 10 années Breton et des achats de merdes dont aucun n’a été relutif et tous massivement dépréciés à 70% ces 3 dernières années.

Le blog vous fait un petit rafraichissement de mémoire avec à l’époque des potentielles possibles magouilles passées à Rhodia et à Thomson, avec nos remerciements pour notre lecteur et sa vidéo Kdo.

J’imagine que ça s’est fini par des non-lieux sinon il ne serait pas resté ministre. Bon, comme le dit un interlocuteur, en étant celui qui contrôle l’AMF, il était apparemment en conflit d’intérêt. Pour ceux intéressés par le fait que dès qu’on creuse un peu on trouve des choses intéressantes dans le parcours de Breton, nous avons mis un résumé à dessein anglo-saxon, c’est-à-dire sans influence de Bercy.

Et puis, de toute façon, c’est JAMAIS SA FAUTE !!!

Understanding Thierry Breton: “Rhodiagate” and the Vivendi Universal Affair

Overview

Understanding Thierry Breton

-

- Part 1: In the Beginning…

-

- Part 5: Chirac’s Entrepreneurial “Joker”

-

- You are here ☞ Part 7: “Rhodiagate” and the Vivendi Universal Affair

-

- Part 8: Insider-Trading Scandal at EADS

-

- Part 9: Noël Forgeard and His “Golden Parachute”

-

- Part 10: What Thierry Did Next…

-

- Part 11: Atos Healthcare – “The Ugly Face of Business”

-

- Part 12: Thierry and the $100 Billion Man

-

- Part 13: Socialising With the Elite

- Part 14: More Influential Friends in High Places

Further parts pending review and research

Summary: When the « Rhodia affair » became the « Breton affair »

Rhodia was a French speciality-chemicals firm which floated on the stock exchanges in Paris and New York in June 1998 after being spun off from its parent Rhodia-Rhone-Poulenc.

Five years after its debut the company ran into serious trouble. It reported a € 1.3 billion loss following write-downs worth €850m. At one stage its shares had lost 95% of their value since the IPO, reaching a low of € 0.95 in 2004.

The economic downturn was partly to blame but a string of risky and ill-judged acquisitions shortly after its IPO also dogged the company.

At its lowest ebb, Rhodia was confronted with a new phenomenon spreading across Europe – shareholder activism – which in the case of Rhodia was mainly aimed at its acquisitions, for example, the US company ChiRex, bought in 2000 for $ 510m in cash in a deal later described as « the most egregious of the many overpriced takeovers of the time ».

The aggrieved shareholders were Hughes de Lasteyrie du Saillant, a scion of one of France’s oldest noble families resident in Belgium, and Edouard Stern, a French investment banker resident in Switzerland.

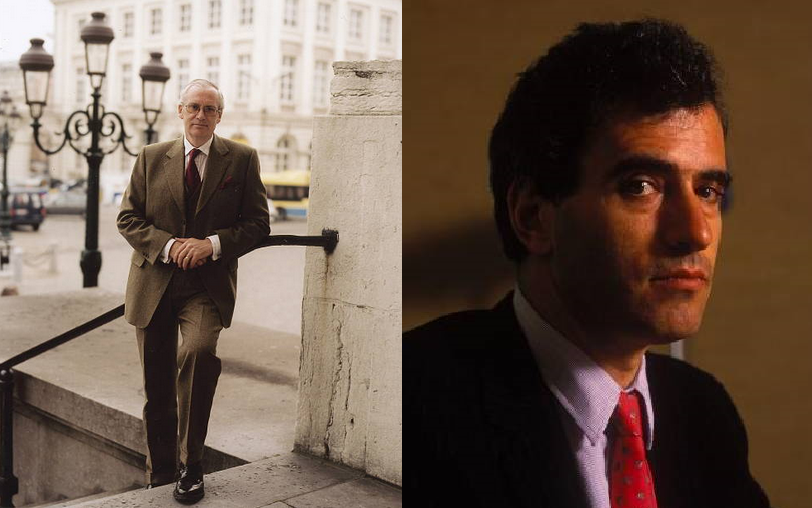

Aggrieved shareholders Hughes de Lasteyrie and Edouard Stern whose complaints led to the « Rhodiagate » scandal.

Stern was found in his apartment in Geneva in February 2005 dressed in a full-body latex suit with his hands tied behind his back and multiple gunshot wounds. In the days following the initial reports of murder, the French and Swiss press ran riot with rumors and speculation about possible links between Stern’s death and Rhodia, the Russian mafia, or both. It was reported that a French prosecutor had suggested to Stern that he purchase a gun in the course of the Rhodia affair.

But the Geneva investigators quickly identified a prime suspect, one of Stern’s paramours, Cecile Broussard, who confessed to the murder which she claimed to have committed in « a moment of passion ».

Meanwhile, at Rhodia the French financial watchdog, Autorité des Marchés Financiers (AMF), opened an official investigation into « misrepresentation of accounts, dissemination of false and misleading stock market information, insider trading and concealment of insider trading » on the company’s accounts between 1999 and 2003.

The AMF settled the case in June 2007, fining Rhodia €€ 750,000 and ex-CEO Jean-Pierre Tirouflet € 500,000 for misleading investors about the group’s debt between 2001 and 2003 as well as financial details surrounding its acquisitions.

What caused the most shock waves in France was that the meltdown of Rhodia happened under the noses of some of the country’s most respected business and government leaders. The company’s board from 1998 to 2002 included Jean-René Fourtou, the former Rhône-Poulenc chief executive who was later brought in to restore financial health to media conglomerate Vivendi Universal after the disastrous reign of Jean-Marie Messier.

The affair was particularly embarrassing for Thierry Breton because he had only been in office as Minister for Economy for around four months when the investigating magistrates ordered a series of searches in connection with investigations relating to « Rhodiagate » and the sale of Canal+ Technologies to Thomson Multimedia by Vivendi Universal in 2002.

Although the two investigations concerned separate matters they were interconnected because the plaintiffs and those potentially implicated were the same in both cases.

Towards the end of June 2005, a total of 15 raids ordered by the magistrates were carried out by investigators and financial police within the space of 48 hours. The searches covered Breton’s ministerial office, his home, the offices of Rhodia, Vivendi Universal, the home of Vivendi’s supervisory board chairman, the offices of Canal+ television and of the Thomson group. The searches took place while Breton was out of the country on official business en route to a UN conference in New York.

This was the first in the history of the Fifth Republic, that the office of a serving minister had been raided. Breton admitted that he had been « flabbergasted » when he had heard about the raids but he rejected suggestions that his position had been in any way compromised by the operation.

After a raid on his office by investigators, the Minister for Finance (Thierry Breton) contemplates where he should start cutting public service posts.

Referring to Rhodia, he claimed that he had done nothing wrong. He insisted that none of the information presented by the management or by auditors had « offended my sense of ethics, my rigour and my principles ». He told the French media that he was « just one small administrator among others » and that attempts to implicate him in corporate malfeasance were « a nauseating manipulation ».

Asked about the raid on the offices of Canal+, he said that was « an entirely different matter » and claimed that he had no longer been at the head of Thomson when the deal was concluded.

Although Breton tried hard to play down the effect of the raids on his ministerial authority, members of the Socialist opposition insisted that he had been weakened. They called on him to explain himself and argued that, as Finance Minister, he was in a conflict of interest.

Chirac was particularly vulnerable after French voters’ rejection of the EU’s proposed constitution and, according to the WSJ, the criminal investigation spawned by de Lasteyrie had the « already scandal-scarred government on edge ».

On 30 June 2005, the Wall Street Journal reported that Breton was « on the ropes » recalling that his predecessor Hervé Gaymard had « only lasted four months before he was forced to leave over a property scandal ».

In July 2005, Les Echos was informing its readers that the « Rhodia affair » had now become the « Breton affair ».

It was starting to look as if the end was nigh for Breton’s political career.

However, as things turned out, reports of his impending political demise were greatly exaggerated and somewhat premature.

At the beginning of 2016, the satirical French weekly Le Canard Enchaîné published allegations that officials at the regulatory authority AMF had toned down criticism of the way officials at Rhodia had managed the accounts in order to protect the Minister for Economy. AMF for its part strenuously denied that it had had « cut passages » that could have been embarrassing for Breton.

Whatever the truth of the matter may be, Breton succeeded in weathering the « Rhodiagate » and Vivendi Universal storms and he remained in office until the end of Chirac’s Presidency.

However, the remainder of his term was overshadowed by turbulences at EADS, including the insider trading scandal and the « golden parachute » affair, which we will look at next.

https://techrights.org/o/2019/11/18/rhodiagate/

=====

Restez automatiquement averti à chaque nouvel article du blog, au rythme maximal de 3 fois par semaine. Inscrivez-vous à notre NEWSLETTER. Cliquez ici. Vous pourrez vous désinscrire à tout moment. Nous utilisons un pluggin officiel WordPress agréé CNIL.

Pensez à inscrire notre domaine bourse.blog en liste blanche, nous avons certains emails non délivrés.

=====

Si vous avez subi des pertes en tant qu’actionnaire ou ancien actionnaire d’Atos, ou en tant que porteur d’options donnant droit à des actions, sachez qu’une action en réparation est en cours de préparation. Des informations complémentaires sont disponibles sur le site Upra.fr (l’Union Pour la Réparation des Actionnaires). Notre association tente, pour la première fois, de lancer une action groupée financée par des fonds spécialisés dans le financement de contentieux. Il s’agit d’une première en France dans un dossier où des manquements à la réglementation boursière et comptable sont suspectés. Et il s’agit aussi d’une chance pour les plaignants puisque cette action est sans aucune avance de fonds, ni aucun engagement financier, hormis en cas de victoire.

La France connaît un précédent significatif de financement de contentieux par des fonds spécialisés. Ce précédent fait suite au gel des avoirs du fonds H20, consécutif à une violation de la réglementation applicable aux gestionnaires de fonds d’actifs. Bien que ce précédent soit quelque peu différent du nôtre, les discussions avec les fonds initiées dès février avancent car il y a de l’intérêt pour pénétrer un nouveau marché en France. Ces discussions sont donc longues en raison de l’absence de précédents, mais elles progressent.

En résumé, que vous soyez actionnaire ou porteur d’options donnant droit à des actions, vous pouvez espérer recouvrer une partie de vos pertes et vous joindre à la cause sans qu’aucun versement de votre part ne soit nécessaire. La réussite de l’action dépendra du nombre de « pertes éligibles » que nous pourrons rassembler. Le caractère éligible ou non des pertes dépend de l’issue des investigations sur les comptes du groupe ces dernières années. Si vous n’êtes pas encore préinscrit sur le site de l’UPRA, il est encore temps de le faire. Un site web sera entièrement dédié à l’action, on espère courant automne.

Pour des raisons de coûts de procédure, elle est réservée aux personnes ayant subi des pertes supérieures à 10 000€ minimum, sinon les coûts judiciaires, avocats, expertises, etc… qui vont se monter en millions d’euros seraient supérieurs à la perte et ne seraient pas rentables pour le fonds de litige. Soyez assuré qu’il ne s’agit pas de snobisme, mais réellement de contraintes financières.